From the Pritska family, who built a $43 billion hotel empire, to the Aden family with 300 ft yachts and lazy river pools. In this video, we’re looking at some of the richest Jewish families in America with fortune so vast they could fund small countries and luxuries beyond imagination. Let’s begin with the Pritska family. 43.1 billion.

Standing at the absolute summit of Jewish American wealth is the Pritska family with their staggering collective net worth of $43.1 billion. This isn’t just money sitting in bank accounts. This is an empire built on hospitality, real estate, and some of the most sophisticated investment strategies ever deployed by a single family.

The Pritska story begins with the kind of American dream narrative that seems almost too perfect to be true. Abram Nicholas Pritsker, the son of Ukrainian Jewish immigrants, earned a Harvard law degree in 1920 and began investing in real estate and small companies starting in 1936 with his brother Jack.

What started as modest investments in Chicago real estate would eventually become one of the most diversified and profitable family business empires in American history. The family’s wealth creation truly accelerated when under Abram’s sons Jay, Robert, and Donald, the family acquired the Hyatt House Hotel in 1957, expanding it into over 150 hotels.

But this wasn’t just about building a hotel chain. The Pritskers understood something fundamental about wealth creation that many other families missed. diversification across multiple industries and the strategic use of complex financial structures.

Their holdings expanded to include the Marmon Group, now owned by Barkshire Haway, Royal Caribbean Cruises, and Ticket Master, sold in 1993. Each of these investments represented not just financial returns, but strategic positioning in industries that would become fundamental to the American economy.

What truly sets the Pritskars apart from other wealthy families is their approach to luxury and their understanding that true wealth isn’t just about accumulation. It’s about creating lasting legacies. Anthony Pritsker owned the yacht Ramble on Rose sold in 2021 and a Gulfream G550 jet. But perhaps even more impressive is Penny Pritskar’s real estate portfolio, which includes a $3.4 $4 million modern mansion in Chicago’s Lincoln Park, a $7.

95 million Georgian home in Massachusetts Avenue Heights, and a Lake Michigan vacation house in Michigan. The family’s spending habits reveal a sophisticated understanding of luxury that goes far beyond simple ostentation. Annual stipens up to $1 million at age 40. Lump sums like $25 million by age 45 and $30 million gifts to children represent not just generosity but strategic wealth management designed to maintain family unity and ensure proper financial education across generations.

Perhaps most remarkably, Anthony built one of America’s largest homes amid a bitter divorce. A project that represents the kind of spending that only becomes possible when wealth reaches truly astronomical levels. The Pritska philanthropy strategy is equally impressive. Jay endowed the Pritskar architectural prize with $100,000 award. While Leisel focuses on impact investing via Blue Haven initiative for social and environmental causes.

This isn’t charity. It’s strategic philanthropy designed to create lasting social impact while building the family’s reputation and influence. With key members like Thomas Hyatt chairman JB Illinois Governor and Penny, former commerce secretary, the Pritskars have successfully translated their business success into political influence, representing a level of power that extends far beyond mere financial wealth. The Pritskars played the long game.

The next family played the house and won big. The Aden family, $34.9 billion. The Aden family’s net worth of $34.9 billion represents one of the most dramatic wealth creation stories in modern American business history. This isn’t just about building a successful business. This is about creating an empire that spans continents and influences global politics at the highest levels.

Sheldon Adles, son of Lithuanian and Welsh immigrants, started selling newspapers at 12, built ComDex, sold for $862 million in 1995, and bought the Sans Casino in 1989 for $128 million, expanding to Macau and Singapore. The transformation from a newspaper selling child to a casino mogul worth tens of billions represents one of the most extraordinary entrepreneurial journeys in American business history.

What makes the Aden story particularly fascinating is how Sheldon’s fortune peaked at $35 billion before his 2021 death. And now Miriam leads with a $32.1 billion net worth from Las Vegas Sands and Dallas Maverick’s ownership. The family’s luxury assets read like something from a fantasy novel.

The 302 ft yacht Queen Mary cost $70 million and features an indoor pool, spa, helipad, and kids playroom accommodating 36 guests. This isn’t just a yacht. It’s essentially a floating palace that represents the kind of luxury that becomes possible when wealth reaches truly astronomical levels. Their aviation assets are equally impressive.

The family owned an Airbus A34500 private jet and maintained a Boeing aircraft fleet representing not just transportation but mobile command centers that allow them to manage their global business empire from anywhere in the world. Their 44,000q ft² Las Vegas mega mansion at 901 Trophy Hills Drive features 15 bedrooms, tennis court, and lazy riverpool.

To put this in perspective, this single home is larger than most apartment buildings and represents the kind of personal luxury that defies conventional understanding. But perhaps what’s most remarkable about the Aden family is how they’ve used their wealth to influence politics. Sheldon donated over $500 million to Republicans, including $180 million in 2020, making him one of the most influential political donors in American history.

Miriam continued this tradition with her $100 million donation to Trump’s 2024 campaign. The family’s business strategy also reveals a sophisticated understanding of global markets. Their casino developments included the Venetian Las Vegas, $ 1.5 billion, Venetian Macau, $2.4 $4 billion and Parisian Macau, $2.

5 billion, representing not just business investments, but strategic positioning in the world’s most lucrative gambling markets. Perhaps most telling about their approach to wealth is the story of how Sheldon committed $3 billion personally during the 2008 crisis to save his company, demonstrating the kind of financial firepower that only becomes available when personal wealth reaches these extraordinary levels.

If the Adles ruled the casino floor, the next family ruled the invisible world of numbers. The Simons family, $31.4 billion. The Simons family’s $31.4 billion fortune represents perhaps the most intellectually fascinating wealth creation story among America’s richest families.

This isn’t wealth built on traditional business models or inherited advantages. This is fortune created through pure mathematical genius and revolutionary approaches to financial markets. Jim Simons founded Renaissance Technologies in 1982 with the Medallion Fund averaging 80% annual returns.

To understand how extraordinary this achievement is, consider that most hedge funds struggle to consistently beat market averages by even a few percentage points. The Simons family essentially created a money printing machine using mathematical algorithms that few people on Earth truly understand. Following Jim Simon’s 2024 death at age 86, his widow Marilyn Simons inherited the $ 31 billion fortune, ranking hash 57 on Forb’s 2025 billionaires list.

But this inheritance isn’t just about money. It’s about continuing a legacy of intellectual achievement that has fundamentally changed how financial markets operate. The family’s luxury assets reflect their unique position at the intersection of intellectual achievement and extraordinary wealth.

Their 222 ft yacht Archimedes built by Feed Ship and refitted in 2018 is used for marine research. This isn’t just a pleasure craft. It’s a floating research laboratory that represents the family’s commitment to advancing human knowledge, even in their leisure activities. Their Gulfream G650 private jet N773 MJ is valued at $70 million.

But what makes this aircraft particularly interesting is that Jim allowed smoking on the jet, affording to pay any resulting fines. This detail reveals something profound about wealth at this level. When you have tens of billions of dollars, traditional rules and restrictions become mere inconveniences that can be bought away.

The family also owns a $48 million Central Park apartment, representing not just luxury living, but strategic positioning in one of the world’s most exclusive real estate markets. What truly sets the Simons family apart is their approach to philanthropy.

Jim donated $6 billion via the Simons Foundation for Math, Science, and Autism Research with plans for $450 million in annual grants. The foundation now has $4.5 billion in assets, making it one of the most significant philanthropic organizations in the world. Their giving strategy reveals a sophisticated understanding of how to create lasting impact. The Flat Iron Institute is planned to expand with a fourth division by 2026, receiving $80 million annually and is designed to last 100 years. This isn’t just charity. It’s strategic investment in humanity’s intellectual future.

Perhaps most remarkably, the family established a Bermuda Foundation with $8 billion in untaxed assets, demonstrating the kind of sophisticated wealth management strategies that become possible when fortunes reach these extraordinary levels.

Marilyn now oversees the foundation’s work, ensuring that the family’s intellectual legacy will continue to advance human knowledge for generations to come. The Simons invested in intellect, the next dynasty invested in the art of looking extraordinary. The Lauder family, $25.9 billion. The Lauder family’s $25.

9 billion fortune represents one of the most enduring and influential business empires in American history. Built on the foundation of beauty and cosmetics, this wealth spans generations and continues to shape how the world thinks about luxury beauty and business succession. SD Lauder founded the cosmetics company in 1946 with Kitchen Creams, growing it to 15.9 billion in sales. This isn’t just a business success story.

It’s a testament to how vision, determination, and strategic thinking can transform a small operation into a global empire that defines entire industries. Leonard Lauder expanded the company significantly with personal assets reaching $233 million in the 1980s. But what makes the Lauder story particularly fascinating is how the family has managed to maintain control and influence across multiple generations while building extraordinary personal wealth.

The family’s approach to luxury reflects their deep understanding of beauty and aesthetics. Jane Lauder’s former $8.9 million Upper East Side penthouse and $12.63 $63 million Nolita triplex represent not just expensive real estate but carefully curated living spaces that reflect the family’s aesthetic sensibilities.

Aarin Lauder’s inherited East Hampton home continues the family tradition of maintaining properties that serve as both personal retreats and showcases for their lifestyle brand. Aarin also owns the Ain luxury brand covering furniture and handbags demonstrating how the family has successfully expanded beyond their core cosmetics business into broader luxury markets.

What makes the Lauder family particularly interesting is their approach to corporate culture and shareholder relations. Their shareholder meetings feature gourmet pastries, tropical fruit, and beauty goodie bags, making them feel like wedding celebrations.

This attention to detail and commitment to creating extraordinary experiences extends far beyond their products into every aspect of their business operations. The family’s philanthropic activities are equally impressive. Leonard donated a $1 billion cubist art collection to the Met Museum and established a $10 million professorship at Yale. This isn’t just wealthy people buying art.

It’s strategic cultural investment designed to create lasting educational and cultural impact. However, the Lauder story also illustrates the challenges that come with managing multigenerational wealth. A succession rift in 2023 led to a $15 billion wealth decline, demonstrating how even the most successful family business empires can face significant challenges when transitioning between generations. Leonard Lauder’s 2025 death prompted reflections on his legacy.

But the family continues to maintain their position as one of America’s most influential business dynasties through generational leadership with William, Aarin, and Jane in key roles. The family’s current collective worth of $25.

9 billion continues to make them one of the most powerful forces in the global beauty industry with influence that extends far beyond cosmetics into art, culture, and philanthropy. The Lorders built an empire in beauty. The next family built theirs in beachfront acres and sky-high price tags. The Ze family, $18.6 billion. The Ze family’s $18.

6 6 billion combined fortune represents one of the most strategic and diversified approaches to wealth creation in American business history. Built initially on publishing success, this family has successfully transformed and modernized their wealth across multiple generations and investment strategies. The family’s grandfather founded Ze Davis in 1927, and their father sold the company for $1.

4 billion in 1994. The brothers then grew their wealth via Ze Brothers Investments, which closed in 2014, and now operate through Ze Capital. This transition from publishing to sophisticated investment management demonstrates the kind of strategic thinking that allows wealthy families to maintain and grow their fortunes across generations.

The family’s approach to luxury real estate is particularly impressive. Their $94 million Manalapan estate was sold in 2021 after being listed for $200 million, spanning 62,200 square ft. To understand the scale of this property, it’s larger than most shopping centers and represents the kind of personal real estate that becomes possible when wealth reaches these extraordinary levels.

The family also maintains Aspen properties worth $44 million plus $20 million in land along with Palm Beach homes valued at $26 million plus additional $20 million in land. This geographically diversified real estate portfolio represents not just luxury living, but strategic asset allocation across some of America’s most exclusive markets. Durk Ze owns the World Surf League, demonstrating how family wealth can be used to acquire and influence entire sports industries. This isn’t just about making money. It’s about purchasing cultural influence and controlling

narratives in popular entertainment. The family’s investment strategy extends far beyond traditional assets. Their former hedge fund operations and current Ze capital management represent sophisticated approaches to growing wealth that few families can successfully implement. What makes the Ze family particularly interesting is their approach to philanthropy.

Through ver initiatives, they’ve donated $5 million for ocean conservation and journalism support. The Natasha and Durk Foundation funds NYC arts and Martha’s Vineyard projects, demonstrating how wealthy families can use strategic giving to influence cultural and environmental causes.

Durk maintains residency in Florida with a philanthropy score of one, representing the kind of tax optimization strategies that become crucial when managing wealth at these levels. The family’s future projections show continued investments with former hedge fund employees and focus on environmental and democracy causes, demonstrating how they’re positioning their wealth to remain relevant and influential in changing social and political environments. The ZIFs mastered real estate.

The New Houses mastered the media that sells the dream. The New House family, $18.5 billion. The New House family’s $18.5 billion fortune represents one of the most enduring and influential media empires in American history. This isn’t just wealth.

It’s cultural power that shapes how millions of people understand fashion, politics, and society through publications that define global conversations. Sam Newhouse started advanced publications in 1922 with Suns Sai and Donald expanding into magazines and newspapers. Current holdings include Conde Nast stakes in Warner Brothers Discovery, Charter, and Reddit, representing a diversified media portfolio that spans traditional publishing, entertainment, telecommunications, and social media.

What makes the New House story particularly fascinating is their recent windfall from technology investments. The family gained $2 billion from Reddit’s IPO, demonstrating how traditional media families have successfully adapted to digital transformation and positioned themselves to benefit from social media’s explosive growth.

The family’s current net worth reached $ 24.1 billion in 2024 with co-presidents Steven, Michael, and Sai 3 leading operations. This multigenerational leadership structure represents sophisticated succession planning that few family business empires successfully implement. The new house approach to business strategy reveals deep understanding of media economics and cultural influence.

They’ve retained publications like Vogue despite financial losses, demonstrating that their media empire isn’t just about immediate profitability, but about maintaining cultural influence and brand prestige. The family has diversified into satellites and software, selling cable operations for 10 billion or more, showing how they’ve strategically evolved their business model to remain relevant in changing technological landscapes.

What’s particularly interesting about the New House Empire is how they’ve managed to maintain editorial independence and cultural relevance while building extraordinary personal wealth. This isn’t treated as a vanity project, but as serious business operations with stable governance structures that allow them to make long-term strategic decisions.

The family’s influence extends far beyond their financial holdings through publications like Vogue, Vanity Fair, and The New Yorker. They shape cultural conversations, influence fashion trends, and provide platforms for important journalism. This cultural influence represents a form of power that money alone cannot buy.

Their adaptation to digital media challenges shows how established media families can successfully navigate industry disruption while maintaining their core influence and growing their wealth. If the new houses controlled the glossy pages of style, the next family controls the snowy slopes where that style is shown off. The Crown family.7 billion. The Crown family’s $14.

7 billion fortune represents one of the most strategically diversified wealth portfolios in American business, spanning defense contracting, manufacturing, luxury, hospitality, and professional sports. This isn’t just money. It’s influence across multiple across sectors that touch nearly every aspect of American economic and cultural life.

Henry Crown founded a building supplies company in 1919, which merged with General Dynamics in 1959. The family now maintains a 10% stake in General Dynamics, providing them with significant influence in one of America’s most important defense contractors.

This represents not just financial investment, but strategic positioning in industries crucial to national security. The family expanded into manufacturing through CC Industries and acquired Aspen Skiing Company along with half ownership of Alterara Mountain Company resorts. Their ski resort holdings include Asp and Snow Mass and half of Alterara’s 16 resorts, including Deer Valley, representing control over some of America’s most exclusive recreational destinations.

Additional holdings include stakes in Illinois Toolworks, the New York Yankees, and Chicago Bulls, demonstrating how wealthy families can acquire influence across multiple entertainment and sports industries. Owning pieces of iconic American sports franchises provides not just financial returns, but cultural influence and social prestige that money alone cannot purchase.

The family’s approach to business leadership emphasizes values-based management. The Henry Crown Fellowship for Leadership represents their commitment to developing business leaders who understand that wealth comes with social responsibility. Their philanthropic strategy reflects sophisticated understanding of how to create lasting social impact.

The family has donated hundreds of millions to education, arts, and health courses with the Henry Crown Fellowship specifically designed to develop leadership skills in business and social sectors. The family’s commitment to sustainability includes a $1.

1 million solar farm, demonstrating how wealthy families can use their resources to advance environmental causes while maintaining profitable business operations. The Crown family story also includes tragedy that illustrates how wealth cannot shield families from life’s uncertainties. James Crown died in an Aspen racetrack accident, reminding us that extraordinary wealth comes with both opportunities and risks.

Current family leadership maintains their philosophy of enlightened self-interest for sustainability, showing how they’re positioning their business empire to remain relevant and profitable in changing environmental and social contexts.

Their future projections show continued investments in defense and resort industries with values-based leadership development through their fellowship programs, demonstrating long-term strategic thinking about wealth management and social influence. If the Crowns command the mountaintops, the next family commands Manhattan’s skyline and the rent checks that come with it. The Goldman family, $13.7 billion. The Goldman family’s $13.

7 billion real estate portfolio represents one of the most concentrated and strategically positioned real estate empires in American history. This isn’t just property ownership. It’s control over crucial pieces of New York City’s economic infrastructure that generates enormous ongoing income streams.

Saul Goldman built NYC’s largest private real estate portfolio with 600 plus properties worth $1 billion at his 1987 death. Current heirs now own 400 plus properties, including some of the most valuable and strategically important real estate in Manhattan. The family owns the ground under Olympic Tower and holds a 17% stake in World Trade Center developments, representing control over pieces of New York’s most iconic and economically important buildings. This isn’t just real estate investment.

It’s ownership of fundamental infrastructure that supports New York’s position as a global financial center. Jane Goldman with a personal net worth of $2.9 billion demonstrates how individual family members have built substantial personal wealth within the larger family empire.

Her Palm Beach estate, purchased for $31 million and sold for $70 million, shows how family members use their real estate expertise to generate profits in luxury markets beyond New York. The family’s wealth management strategy has created some extraordinary personal collections. Alan Goldman’s estate included $100 million in stocks, homes, and a multi-million dollar coin collection, demonstrating how real estate wealth can be diversified into other luxury assets and investments.

However, the Goldman family story also illustrates the complex challenges that come with managing multigenerational wealth. The family is currently engaged in a bitter feud over the 1.7 billion empire with accusations of mismanagement and surveillance.

The ongoing legal battles have blocked $100 million plus in distributions, showing how family disputes can significantly impact wealth management and distribution strategies. The feud includes dramatic accusations, including claims about hitmen, illustrating how extraordinary wealth can sometimes lead to extraordinary family conflicts.

Recent lawsuits against Jane Goldman reveal family tensions over property appraisals and luxury assets like the Grammy Park Hotel, demonstrating how real estate empires can become sources of family division rather than unity. Despite these challenges, the family’s real estate portfolio continues to generate enormous income from some of New York’s most valuable properties.

Their holdings represent not just wealth, but strategic control over pieces of real estate infrastructure that will likely remain valuable regardless of broader economic changes. If the Goldmans own the ground where fortunes are made, the next family sails the seas where fortunes are spent. The Arison family, $13.5 billion. The Arison family’s $13.

5 billion fortune represents one of the most globally influential business empires built on leisure, hospitality, and maritime transportation. This isn’t just wealth. It’s control over an industry that moves millions of people annually and shapes how the world thinks about vacation travel and luxury experiences.

Ted Arison founded Carnival Corporation in 1972 with son Mickey expanding the business significantly. Daughter Sherry inherited substantial holdings and sold her bank Hapoalem stake in 2024, demonstrating how family members have successfully diversified their wealth across multiple industries and geographic markets.

The family’s approach to luxury assets reflects their deep understanding of maritime luxury and hospitality. Sharie Harrison owns the yacht Megan built by feedship for $50 million or more along with her former yacht My Shanty. She also owns a Boeing 757 private jet N757 AG representing the kind of integrated luxury transportation system that allows global business management from anywhere in the world.

Mickey Arison owns multiple yachts including Milein 4, Cerrona and Sixth Sense along with a Gulfream G650 N35cc. The family’s yacht collection represents not just luxury assets, but floating showcases for the hospitality expertise that built their cruise line empire. The family maintains luxury real estate, including Bal Harbor properties worth $5.8 million, positioning them in some of Florida’s most exclusive residential markets while maintaining proximity to their cruise line operations.

What makes the Arison family particularly interesting is their commitment to philanthropy and social impact. The Ted Arison Foundation, established in 1981, focuses on Holocaust survivors with good deeds day now celebrated in 115 countries. The foundation also invests in desalination and solar plants, demonstrating how cruise line wealth can be redirected towards environmental and humanitarian causes.

Sher Harrison’s net worth of $5 billion makes her Israel’s richest woman, while Mickey Harrison maintains $ 8.65 billion from Carnival Cruises. This geographic distribution of family wealth across the United States and Israel represents sophisticated international wealth management and cultural connection strategies.

The family’s business strategy reveals deep understanding of global hospitality markets. Carnival Corporation generates $20 billion in annual turnover, making it one of the world’s largest leisure travel companies. Mickey also owns the Miami Heat, demonstrating how cruise line wealth can be diversified into professional sports ownership.

The family’s annual foundation contributions of $40 million with $ 160 million in foundation assets represent significant ongoing commitment to philanthropy that extends far beyond simple charity into systematic social impact investment. Personal touches in their luxury assets reveal family values and connections.

The yacht Megan is named after Shar’s daughter, while Milin IV is named after Mickey’s mother, Lynn, showing how even extraordinary luxury purchases reflect family relationships and emotional connections. Shar’s 2024 focus on impact investing in water and sustainability projects demonstrates how cruise line wealth is being repositioned to address global environmental challenges, particularly relevant given the cruise industry’s environmental impact concerns. The Arison family success represents the transformation of immigrant entrepreneurship into global

business leadership. With Ted starting as an immigrant and building an empire that now influences how millions of people experience leisure travel. From floating palaces to iconic hotels and stadiums, the next dynasty turned wealth into lasting cultural influence. The Tish family, $10.1 billion.

The Tish family’s $10.1 billion fortune represents one of the most strategically diversified and professionally managed family business empires in American history. This isn’t just wealth accumulation. It’s systematic empire building across multiple industries with sophisticated succession planning that has successfully navigated generational transitions.

Brothers Bob and Larry Tish acquired Lowe’s theaters in 1959 and built an $18.5 billion conglomerate spanning insurance hotels, energy, and entertainment. The family owns 50% of the New York Giants, valued at $6.8 billion, representing not just financial investment, but cultural influence in America’s most popular sport.

The family operates 26 Lowe’s hotels, providing them with significant influence in the luxury hospitality industry. This hotel portfolio represents not just revenue generation, but strategic positioning in markets that serve wealthy travelers and business executives globally. Lowe’s Corporation’s total value of $18.

5 billion encompasses insurance through CNA financial hotels, boardwalk pipelines, and Alium packaging, demonstrating the kind of diversified business portfolio that few families successfully manage across generations. The family’s approach to luxury real estate reflects both personal enjoyment and strategic asset allocation.

James Tish owns a $41 million Hampton’s oceanfront home, while Henry Tish maintains a Central Park West apartment. These properties represent not just luxury living, but strategic positioning in markets that appreciate consistently over time. What makes the Tish family particularly impressive is their successful implementation of generational leadership transition.

Ben Tish became CEO in 2025, representing third generation leadership, while James continues as chairman. This succession planning represents sophisticated family business management that few dynasties successfully achieve. The family’s strategy focuses on growing intrinsic value and cash flow investments with shares up 55% over the past 5 years, demonstrating that their wealth management approach generates consistent returns while maintaining long-term strategic positioning. The family sports ownership represents more than financial investment. Their acquisition of 50% of

the New York Giants for $75 million in 1991 has appreciated enormously. But more importantly, it provides cultural influence and social prestige that extends far beyond monetary returns. The family’s commitment to philanthropy includes generous NYC giving and a $10 million donation to TUS in 1996, demonstrating systematic approach to community investment that builds social capital alongside financial wealth.

Recent family developments show continued strategic thinking about public service and social impact. Jessica Tish’s 2024 appointment as NYPD Commissioner demonstrates how family members use their wealth and education to serve in important public roles.

With her personal net worth estimated between $3 million to $10 million, representing individual success within the larger family enterprise. The Tish family’s business model emphasizes cash flow generation and value creation rather than rapid growth, representing conservative wealth management principles that prioritize preservation and steady growth over speculative risk-taking.

Their success across multiple generations demonstrates how wealthy families can maintain relevance and influence by adapting their business strategies while preserving core values and a systematic approach to wealth creation and management. Thank you for watching.

If you enjoyed watching this video, click on one of the boxes playing on your screen to watch more similar content.

News

Inside Willow Run Night Shift: How 4,000 Black Workers Built B-24 Sections in Secret Hangar DT

At 11:47 p.m. on February 14th, 1943, the night shift bell rang across Willow Run. The sound cut through frozen…

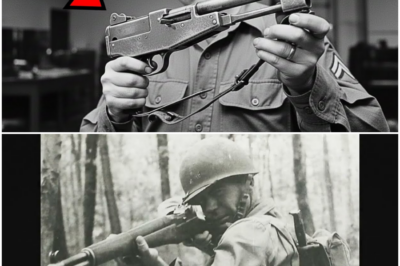

The $16 Gun America Never Took Seriously — Until It Outlived Them All DT

The $16 gun America never took seriously until it outlived them all. December 24th, 1944. Bastonia, Belgium. The frozen forest…

Inside Seneca Shipyards: How 6,700 Farmhands Built 157 LSTs in 18 Months — Carried Patton DT

At 0514 a.m. on April 22nd, 1942, the first shift arrived at a construction site that didn’t exist three months…

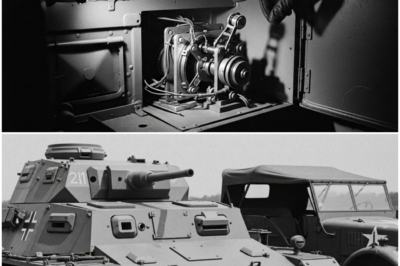

German Engineers Opened a Half-Track and Found America’s Secret DT

March 18th, 1944, near the shattered outskirts of Anzio, Italy, a German recovery unit dragged an intact American halftrack into…

They Called the Angle Impossible — Until His Rifle Cleared 34 Italians From the Ridge DT

At 11:47 a.m. on October 23rd, 1942, Corporal Daniel Danny Kak pressed his cheek against the stock of his Springfield…

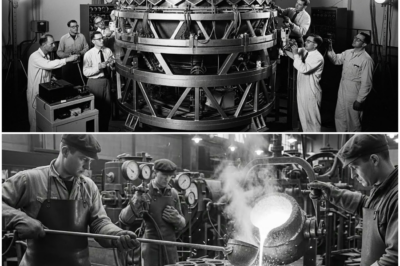

The Trinity Gadget’s Secret: How 32 Explosive Lenses Changed WWII DT

July 13th, 1945. Late evening, Macdonald Ranchhouse, New Mexico. George Kistakowski kneels on the wooden floor, his hands trembling, not…

End of content

No more pages to load